There is never too much to offer!

To enroll in eDocuments follow the steps below:

-

Log in to Digital Banking.

-

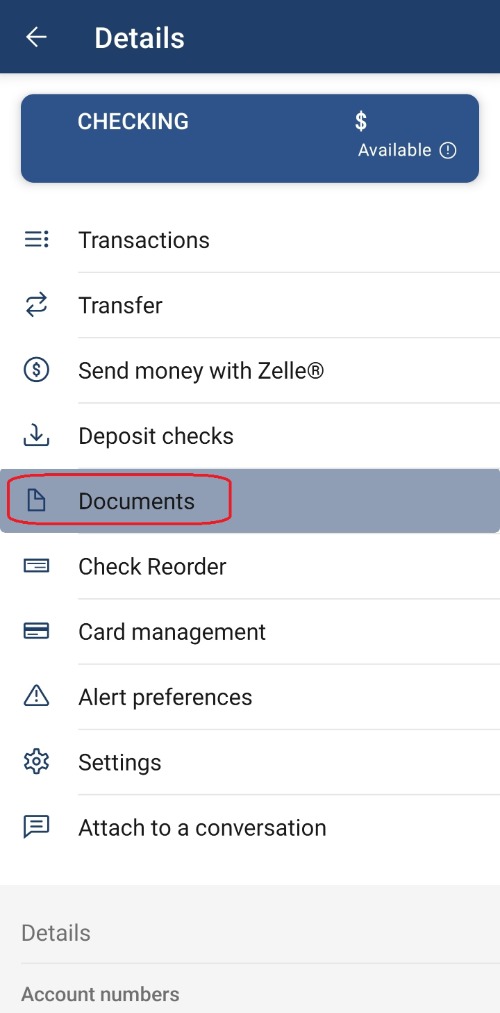

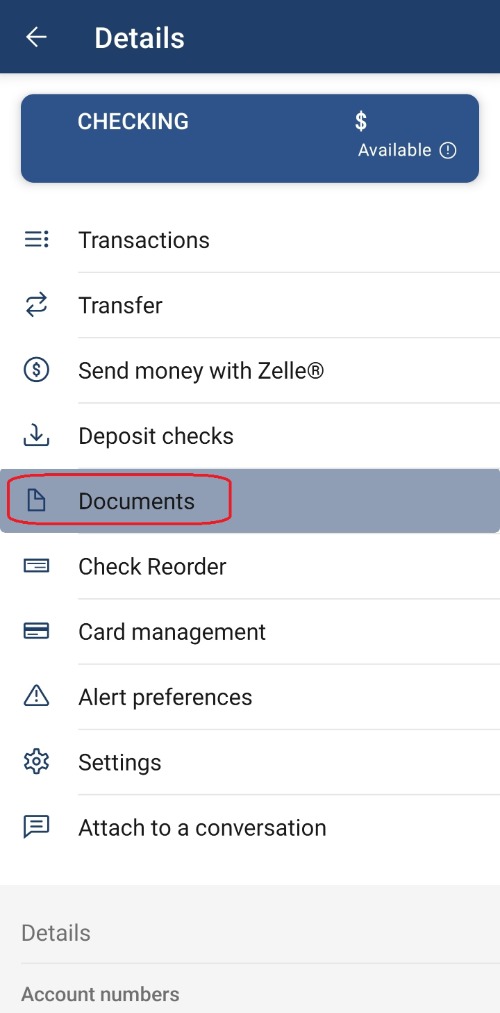

Click on the Documents tab under one of your accounts menu

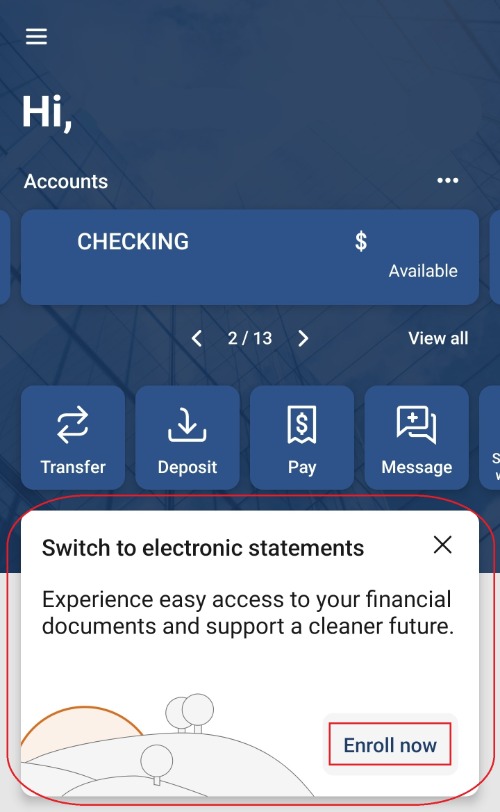

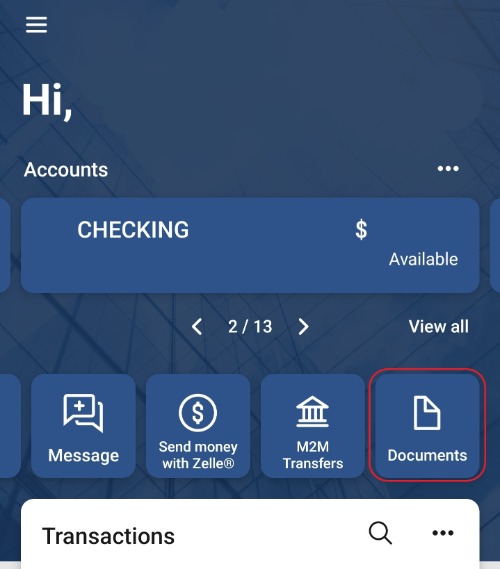

or you can enroll with a prompt displayed on the dashboard.

-

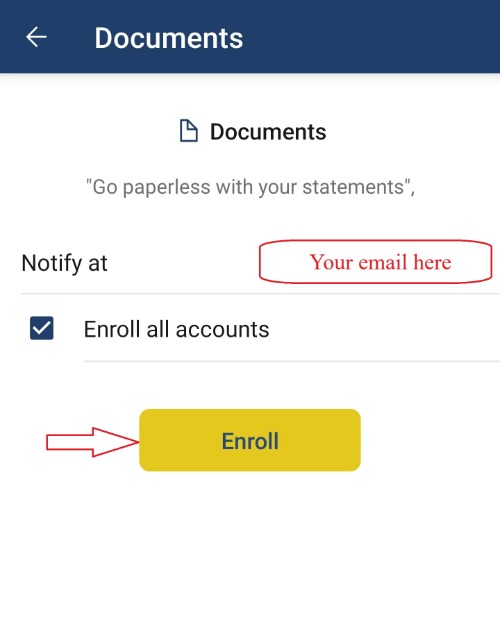

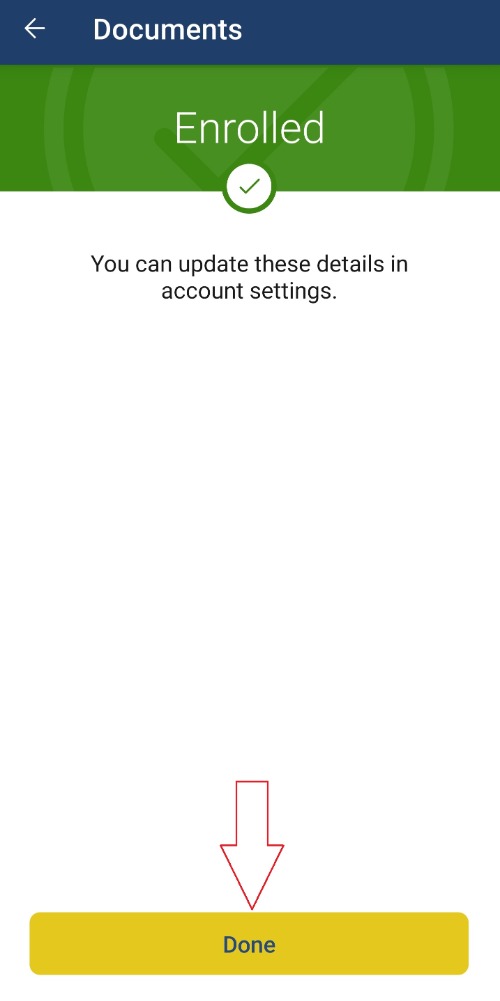

Follow the on-screen instructions.

(Please note that eDocuments will be available within the next 12-24 hours after enrollment)

eDocuments can be accessed from the Accounts Details menu

and via the Documents shortcut on the Dashboard

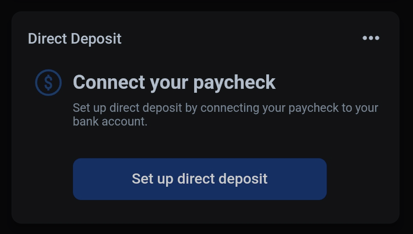

- This is what the new tile looks like in our digital banking app:

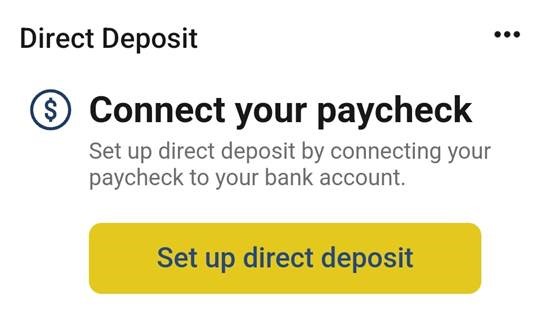

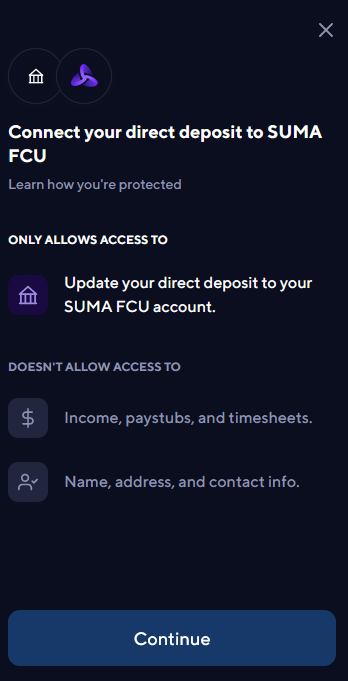

- After clicking on the “Set up direct deposit” button, a new window opens confirming what is and what is not accessed during this process:

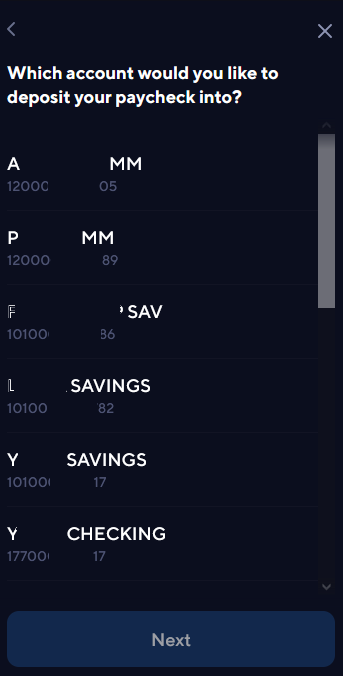

- After clicking the “Continue” button, you will see a list of your SUMA FCU shares that you can select as the final destination of your direct deposit:

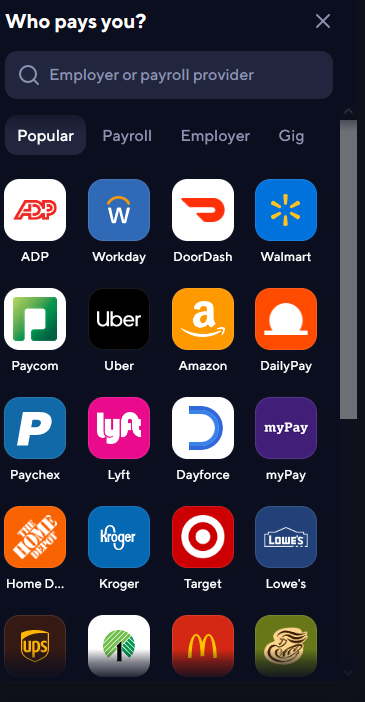

- After choosing a share and clicking “Next”, a new window will show you a list of popular payroll providers, employers, and agencies from which to choose or, if not listed, you can search for yours:

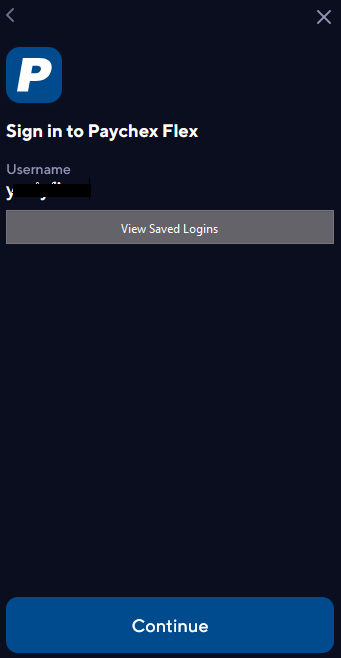

- After choosing your direct deposit provider, you will see a login window to your provider:

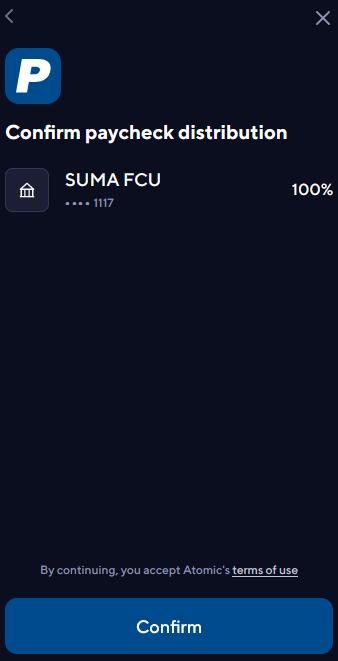

- After successful login, the “Confirm” button appears - once clicked, the switch is performed:

Note: It may take 1 or 2 payroll cycles (depending on the employer/agency) for a switch to complete.

Some payroll providers, employers, or government agencies may require additional verification steps.

If you provider is not listed, use the other way or reach out to us. We can provide paperwork that you can show your company's HR department to speed up the desired direct deposit switch.

Feel free to contact us, at any point through the process, if you have any questions.

*Savings – must be 13-digits long, starting with 101, followed by the appropriate amount of zeros and ending with your membership account number without any dashes or suffixes (e.g., if your membership number is 12345, then your full 13-digit savings account number should be 1010000012345; if you have an additional savings account under the same membership number, then your second full 13-digit savings account number may be as follows – 1020000012345,and so forth – 103…, 104…, etc.).

**Checking accounts – must be 13-digits long, starting with 177, followed by the appropriate amount of zeros and ending with your membership number without any dashes or suffixes (e.g., if your membership number is 12345, then your full 13-digit checking account number should be 1770000012345; if you have an additional checking account under the same membership number, then your second full 13-digit checking account number may be as follows – 1780000012345, and so forth).

- Make withdrawals or transfer funds at your convenience

- Available on-site at 125 Corporate Blvd., Yonkers NY 10701

- Unlimited access to nearly 30,000 surcharge-free ATM within CO-OP Network nationwide

Are you in a rush? Do your banking without getting out of your car. Convenient, fast, secure!

Drive-Thru Window Service is available only at our Corporate Branch at 125 Corporate Blvd., Yonkers, NY 10701.

Sometimes getting to the bank during business hours can be hard or inconvenient. For those instances our members can take advantage of SUMA FCU's Night Depository Service. Night Deposit has the following helpful features for members:

- Special bags that offer more security and convenience.

- Validated deposit receipts.

- No more standing in line waiting for a teller to verify your cash or checks.

Night Depository Service is available only at our Corporate Branch at 125 Corporate Blvd., Yonkers, NY 10701.

SUMA FCU can provide a teller's check for payment to a third party at your direction. A fee may be applicable for each official credit union check you need created. The value of the teller's check is that the payee can be certain the check will be backed by adequate funds and no chance the item will be returned.

Teller's checks can be ordered at any SUMA FCU branch during normal business hours. As an alternative, you may order a check withdrawal from SUMA FCU Online & Mobile Banking BillPay and make it payable to the third party at no charge to you.

You need our Routing Number (221981254) and your 13-digit MICR account number. The MICR number can be found at the bottom of one of your existing checks.

You can also use your Reorder Form with the Order Identification Number and Check Number.

If this is your first order or the information that appears on your checks (e.g., address or name) has changed since your last order, please contact us at 914-220-4900

Check order option is also available in SUMA FCU Online & Mobile Banking under your Checking account details.

SUMA FCU offers foreign and domestic Wire Transfer services (incoming and outgoing).

This service lets you send money from your SUMA checking, savings or money market account to accounts at other financial institutions in the U.S. and internationally. Wire transfers are great for scheduling regular transfers – say to a friend or relative – or even if you need to make a one-time transaction, for example, if you’re closing on a home. You can do it over the phone by contacting our Member Service Department.

How It WorksHere's what you need to know about wire transfers:

- To send a wire transfer, simply have the recipient's account and destination bank information available.

- Wires are generally sent the same business day if processed before 3 p.m. ET.

- You can also save and reuse wire information and see all past and future wires if there is Funds/Wire-Transfer Agreement on file at the Credit Union.

- Available at our Corporate Branch

- Wide range of sizes from 3x5 to 10x10

- Rental rates vary depending on box size

Medallion Signature Guarantees can be obtained from SUMA FCU.

Medallion Signature Guarantee Programs approved by SUMA FCU are:

- STAMP (Securities Transfer Agent Medallion Program)

- SEMP (Stock Exchanges Medallion Program)

- MSP (New York Stock Exchange Inc. Medallion Signature Program)

The Guarantee should NOT be dated.

If a Medallion Signature Guarantee is dated, it is only good for that date.

A Medallion imprint can certify documents for which we will accept photocopies. (Note a Medallion Signature Guarantee has the same meaning as the previously required phrase "Guaranteed that the within is a true and correct copy of the original and is in full force and effect and that the maker is alive as of ..."). Medallion Signature Guarantees do not omit the need for required legal documents, such as death certificates, tax waivers, or corporate resolutions.