We hope you and your families are well and healthy.

For Immediate Release Effective: January 1, 2025

SUMA Federal Credit Union Announces Strategic Leadership Transition: New CEO Appointed as President Continues to Guide Organization

SUMA FCU is pleased to announce a significant leadership transition designed to strengthen its organization and enhance its ability to serve its members. Effective January 1, 2025, Andrij G. Burchak will assume the role of Chief Executive Officer, while Roman G. Kozicky will continue to serve as President.

New Leadership Structure

This strategic decision to divide the roles of President and CEO reflects SUMA’s commitment to organizational growth and adaptability in an ever-changing financial landscape. By leveraging the strengths of both leaders, SUMA FCU aims to drive innovation, improve member experiences, and accelerate its strategic initiatives while maintaining traditional community involvement.

Introducing its New CEO

Andrij brings a wealth of experience to SUMA FCU. He has served the past 21 years as a member of the SUMA FCU Board of Directors. For the last four years, Andrij has also held the title of Executive Vice President - Governance, Planning & Development. During this period Mr. Burchak has focused on improvement of SUMA’s digital transformation and member-centric strategies as well as organizing the facilities and operations of SUMA’s entry into the Florida market. His background includes leadership roles in multiple organizations with operations, sales and marketing being his forte. Andrij has continuously been an active member within the Yonkers community, most importantly, as the President of the Ukrainian Youth Association in Yonkers for 10 years. He has a proven track record of building dynamic teams, forward thinking organizational and planning with a focus on end-user experience.

"I am honored to expand my role within the exceptional team at SUMA FCU," said Mr. Burchak. "I look forward to building on its strong foundation and working alongside President Roman G. Kozicky to enhance SUMA’s services, embrace technological advancements, and further its commitment to its members' financial well-being."

Continued Leadership

Roman G. Kozicky will continue to play a crucial role in guiding its credit union's strategic direction and maintaining SUMA’s strong community connections. His experienced legal incite, his intimate knowledge of the entire loan process and his deep understanding of SUMA FCU’s organization will be invaluable as the credit union navigates this transition and pursues its long-term goals. During Mr. Kozicky’s decade tenure as President/CEO, he oversaw the critical transition to digital banking, maintained full operation of all banking services through the challenges of the COVID-19 pandemic, developed an outstandingly expert staff, and administered SUMA’s momentous expansion with two new branches in North Port and St. Petersburg, Florida. “SUMA is very fortunate to have Andrij as the perfect candidate to maintain SUMA’s unparalleled position in innovation by taking the reins of leadership into the next phase of high-tech financial services,” Mr. Kozicky assuredly said.

Andrew S. Horbachevsky, Chairman of the Board of Directors, expressed confidence in the new leadership structure: "This transition represents an exciting new chapter for SUMA FCU. We believe that Andrij's fresh perspective, combined with Roman's continued guidance, will position us for sustained success and enable us to better serve its members and communities."

Looking Ahead

As it embarks on this new era of leadership, SUMA FCU remains committed to its core values of providing the best possible rates and the highest level of innovative service, member financial empowerment, and an advanced digital banking experience paired with deep community engagement, supporting many of the local community churches and organizations, as well as supporting Ukraine in its fight for independence. SUMA FCU is confident that this strategic realignment will drive the institution forward, ensuring it continues to meet the evolving needs of its members while maintaining the personal touch that sets SUMA FCU apart.

SUMA FCU invites its members, employees, and community partners to join them in welcoming Andrij G. Burchak in his new role and in supporting SUMA’s leadership team as they work together to build a stronger financial future for all.

For more information contact: Roman G. Kozicky 914-220-4900

**********

For Immediate Release Effective: January 1, 2025

Федеральна Kредитова Кооператива СУМА оголошує про стратегічну зміну керівництва: новий генеральний директор, призначений президентом, продовжить керувати організацією

ФКК СУМА рада повідомити про значну зміну керівництва, покликану зміцнити організацію та підвищити її спроможність служити своїм членам. З 1 січня 2025 року Андрій Бурчак обійме посаду Головного Виконавчого Директора, а Роман Козіцький продовжить виконувати обов'язки Президента.

Нова структура керівництва

Це стратегічне рішення про розподіл ролей Президента та Головного Виконавчого Директора відображає прагнення СУМА до організаційного зростання та адаптивності в умовах постійно мінливого фінансового ландшафту. Використовуючи сильні сторони обох лідерів, ФКК СУМА має на меті впроваджувати інновації, покращувати досвід членів та прискорювати реалізацію стратегічних ініціатив, зберігаючи при цьому традиційну участь у житті громади.

Представляємо нового генерального директора

Андрій приносить в ФКК СУМА багатий досвід. Попередній 21 рік він був членом Ради Директорів ФКК СУМА. Протягом останніх чотирьох років Андрій також обіймав посаду Виконавчого Віце-Президента з Управління, Планування та Розвитку. Протягом цього періоду пан Бурчак зосередився на вдосконаленні стратегій цифрової трансформації та клієнтоорієнтованості СУМА, а також на організації об'єктів та операцій, пов'язаних з виходом СУМА на ринок штату Флорида. Його досвід роботи включає керівні посади в різних організаціях, де його сильними сторонами є операційна діяльність, продажі та маркетинг. Андрій постійно бере активну участь у житті громади Йонкерса, зокрема, протягом 10 років був президентом Спілки Української Молоді в Йонкерсі. Він має перевірений досвід побудови динамічних команд, перспективного організаційного мислення та планування з акцентом на досвіді кінцевого споживача. «Для мене велика честь розширити свою роль у винятковій команді ФКК СУМА.» - сказав пан Бурчак. «Я з нетерпінням чекаю на те, що будуватиму роботу на її міцному фундаменті та працюватиму разом з Президентом Романом Козіцьким над покращенням послуг СУМА, впровадженням технологічних досягнень та подальшим зміцненням прихильності до фінансового добробуту своїх членів.»

Подальше лідерство

Роман Козіцький і надалі відіграватиме вирішальну роль у визначенні стратегічного напрямку розвитку кредитної спілки та підтримці міцних зв'язків СУМА з громадськістю. Його досвідчені юридичні знання, глибоке знання всього кредитного процесу та значне розуміння організації ФКК СУМА будуть неоціненними, оскільки кредитна спілка проходить цей перехідний період та переслідує свої довгострокові цілі. Протягом десятирічного перебування пана Козіцького на посаді Президента/Головного Виконавчого Директора він здійснював нагляд за критично важливим переходом до цифрового банкінгу, підтримував повноцінне функціонування всіх банківських послуг в умовах пандемії COVID-19, сформував команду висококваліфікованих фахівців та керував значним розширенням СУМА за рахунок відкриття двох нових відділень у Норт-Порті та Ст-Петербурзі, штат Флорида. «СУМА дуже пощастило, що Андрій є ідеальним кандидатом для збереження безпрецедентної позиції СУМА в інноваціях, взявши кермо лідерства у наступний етап високотехнологічних фінансових послуг.» - запевнив пан Козіцкий. Андрій Горбачевський, Голова Ради Директорів, висловив упевненість у новій структурі керівництва: «Цей перехід представляє нову захоплюючу главу для ФКК СУМА. Ми віримо, що свіжий погляд Андрія у поєднанні з постійним керівництвом Романа забезпечить нам стабільний успіх і дозволить нам краще служити нашим членам і громадам».

Погляд у майбутнє

Вступаючи у нову еру лідерства, ФКК СУМА залишається відданою своїм основним цінностям, які полягають у наданні найкращих можливих відсотків по позиках та на депозити та найвищого рівня інноваційного обслуговування, розширенні фінансових можливостей членів та передового досвіду цифрового банкінгу у поєднанні з глибоким залученням громади, підтримкою багатьох місцевих церков та організацій, а також підтримкою України у її боротьбі за незалежність. ФКК СУМА впевнена, що ця стратегічна перебудова рухатиме організацію вперед, гарантуючи, що вона продовжуватиме задовольняти зростаючі потреби своїх членів, зберігаючи при цьому індивідуальний підхід, який вирізняє ФКК СУМА з-поміж інших.

ФКК СУМА запрошує своїх членів, співробітників та громадських партнерів приєднатися до них і привітати Андрія Бурчака у його новій ролі, а також підтримати команду керівництва ФКК СУМА у їхній спільній роботі над побудовою сильнішого фінансового майбутнього для всіх.

For more information contact: Roman G. Kozicky: 914-220-4900

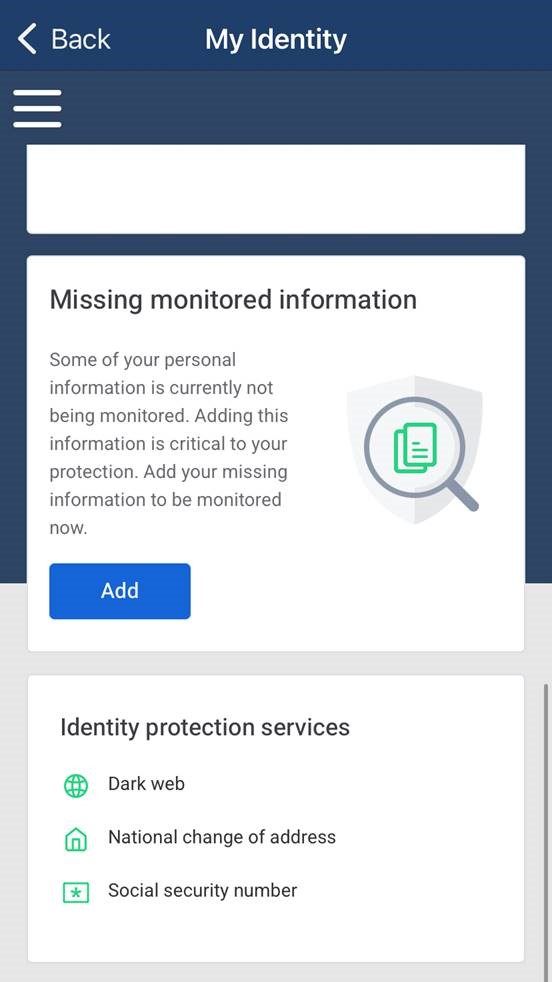

- Dark web monitoring

- SSN monitoring

- Change of address

- Sign in to your SUMA FCU Digital Banking app.

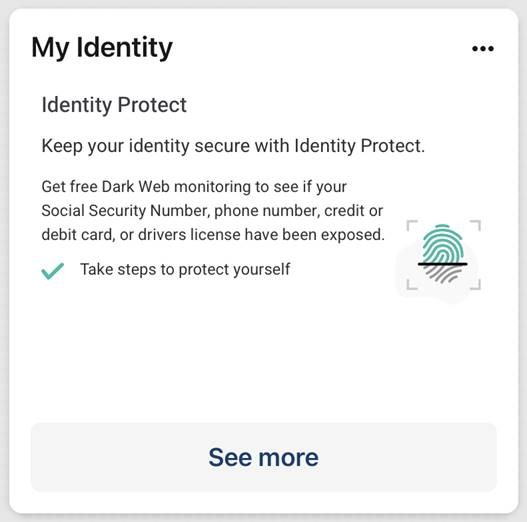

- Scroll down on your Dashboard and click “See More” on the “My Identity” tile:

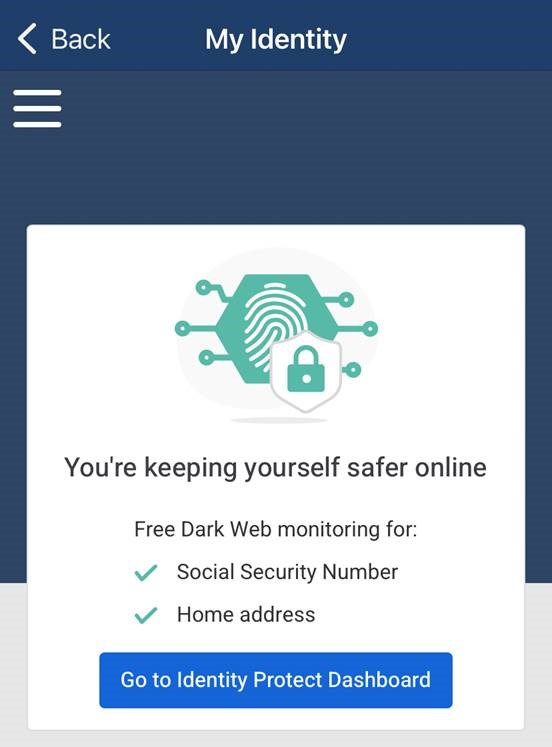

- Click “Go to Identity Protect Dashboard”

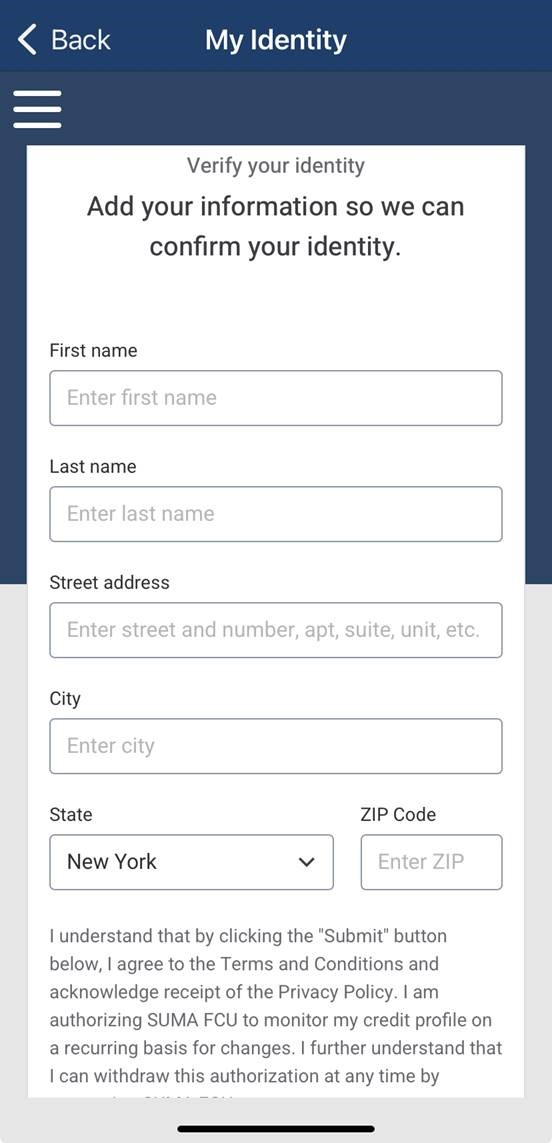

- Confirm or add your information and click to proceed:

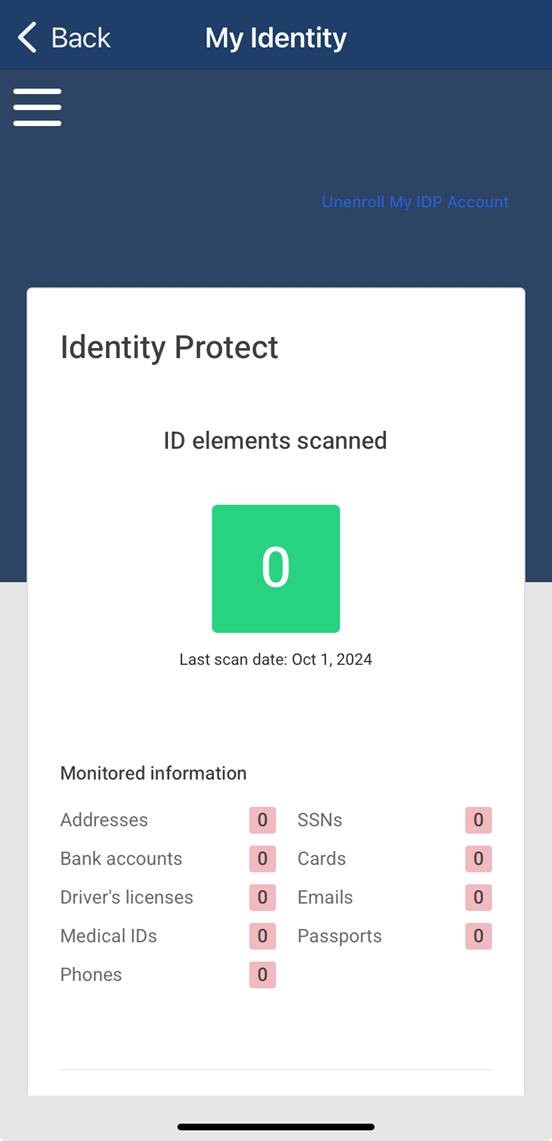

- After registration, your “My Identity” tile dashboard will look like this:

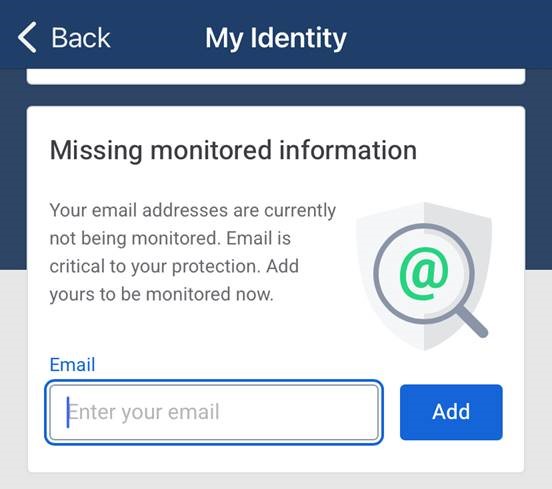

- Enter one of your email addresses for monitoring and click “Add”:

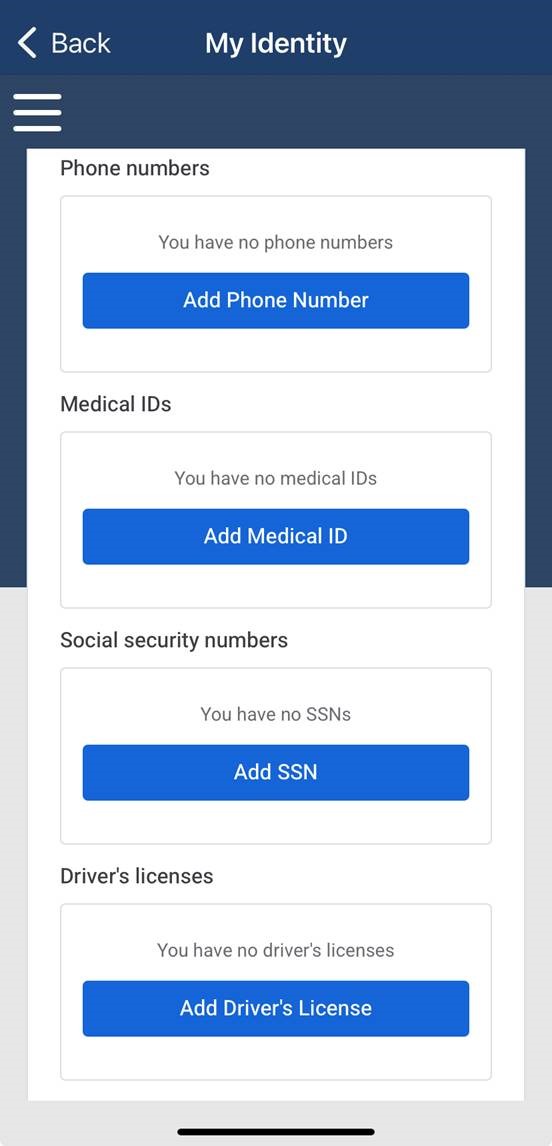

- Click “Add” to add other information categories for monitoring (they are not populated automatically to allow you to enroll just yours and/or your family’s information):

- The following information categories are available for monitoring:

- Addresses

- Emails

- Phone Numbers

- Medical IDs

- Social Security Numbers

- Drivers Licenses

- Passports

- Credit and Debit Cards

- Bank Accounts

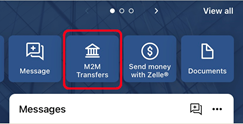

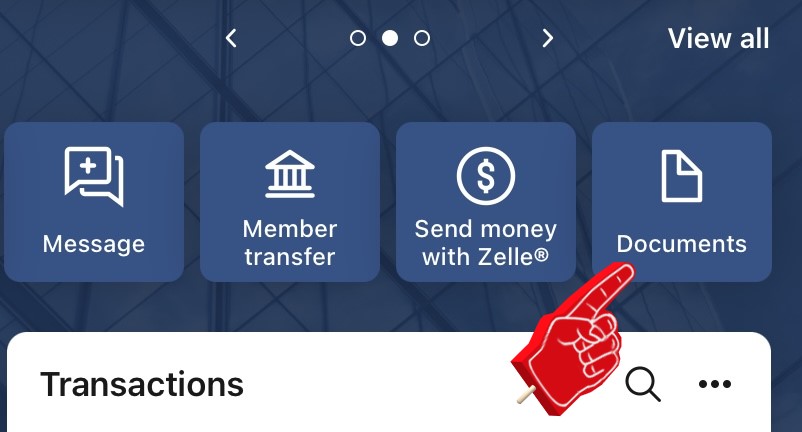

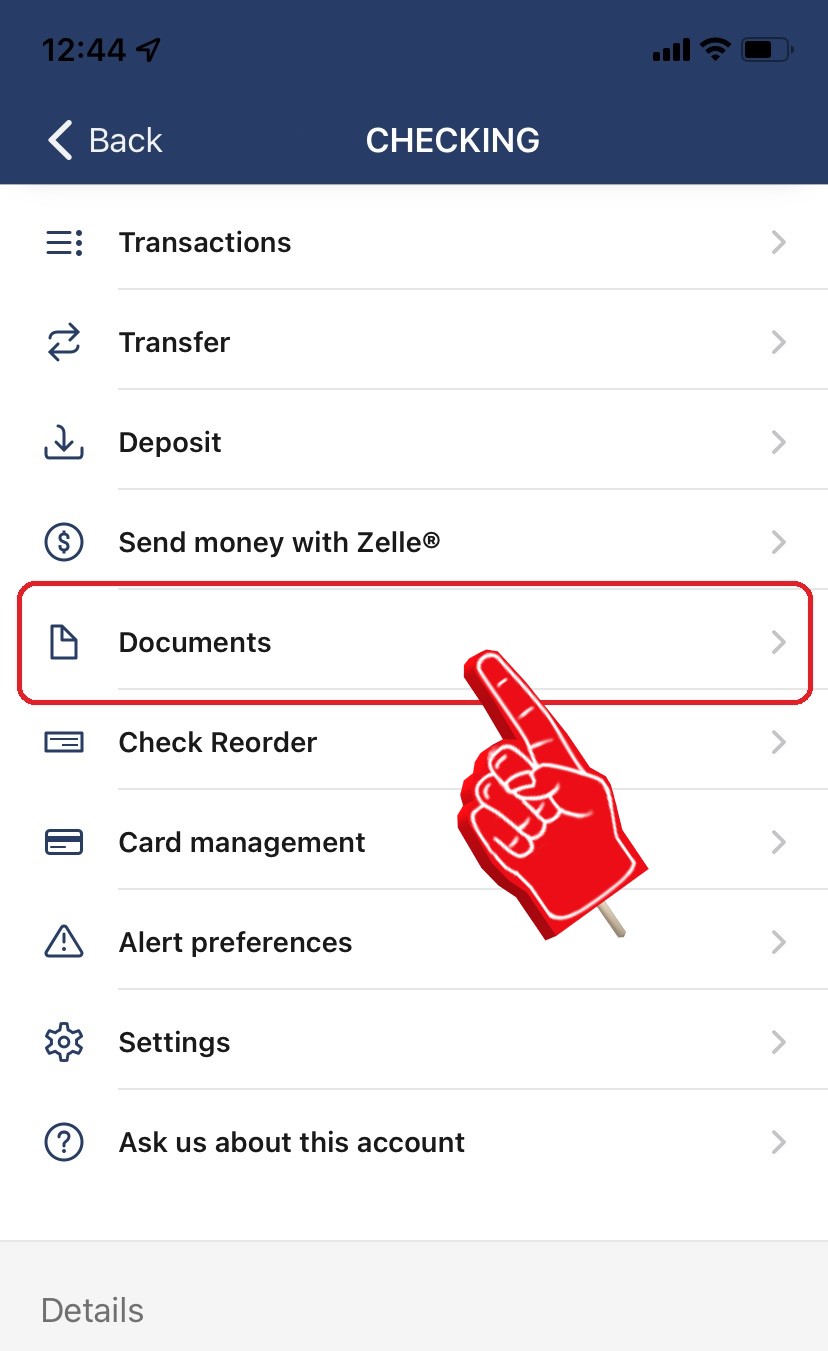

Find the updated widget in our digital banking app:

Now you can:

- SCHEDULE transfers

- make transfers RECURRING (weekly, monthly, every two weeks, twice a month)

- SAVE INFO for future use (save with Nickname)

- SELECT the exact account where you would like to make the transfer

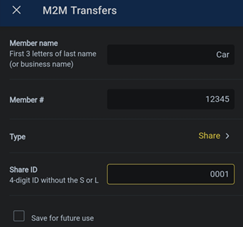

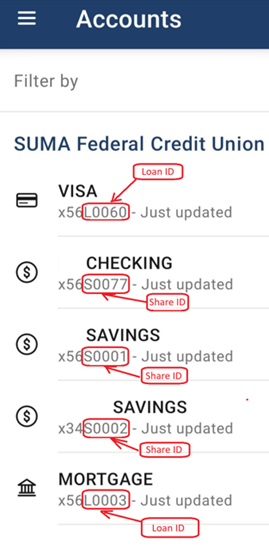

Note:

You will need to select if transferring to a “S” (Share = Savings or Checking account) or an “L” (Loan)

You will need to also enter the Share ID (must be 4 digits)

Some examples:

- If your recipient’s Share ID is 1 (savings), enter 0001.

- If your recipient’s Share ID is 77 (checking), enter 0077.

(Confirm the ID with your recipient as they may have more than one type of share or loan ID.

You can find your IDs in the SUMA Digital Banking app.

Click the hamburger bar > click Accounts and you will find a list as seen below:

If you have any questions, feel free to contact us.

If you’re headed off to college soon, we’re here to help you cover those expenses.

SUMA FCU’s new student loan marketplace offers competitive rates, flexible repayment options, and absolutely zero fees – and, of course, personalized member service for you and your family.

Click below to find your next steps.

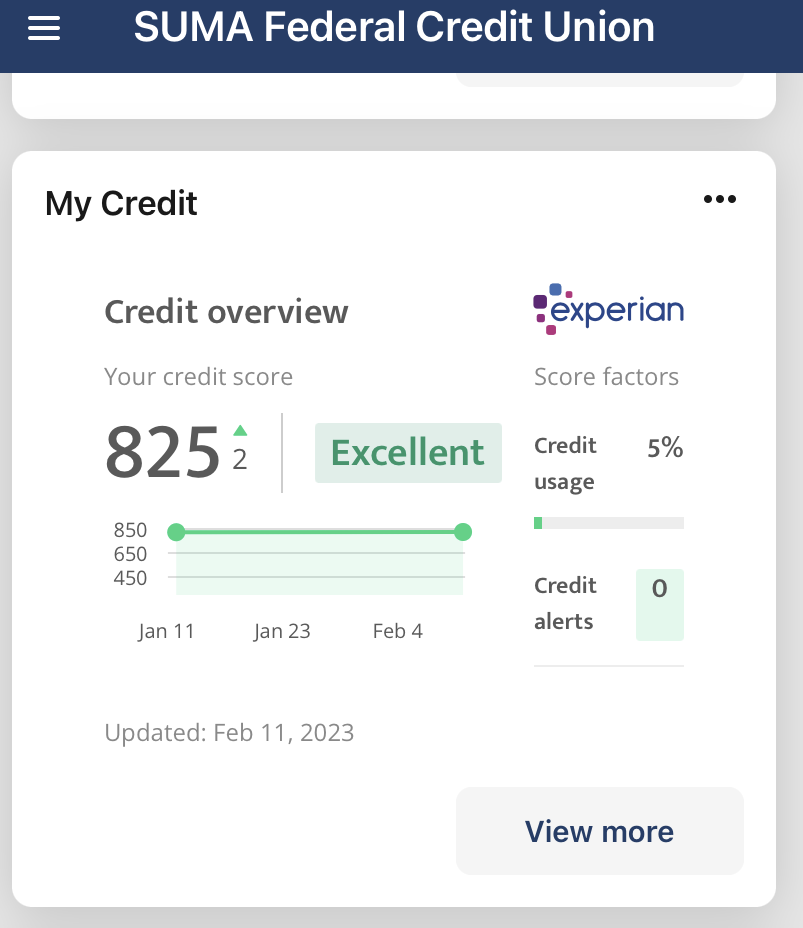

You may have noticed a new service in your SUMA digital banking app:

My Credit

- See your credit score, review your account and history, and simulate ways to improve your credit score.

The widget should automatically appear at the bottom of your SUMA FCU digital banking app.

If you don’t see it, add them by clicking on the “Organize dashboard” button at the bottom and then click “Add a card” button and find/add them there.

If you have any questions, please reach out to us for assistance.

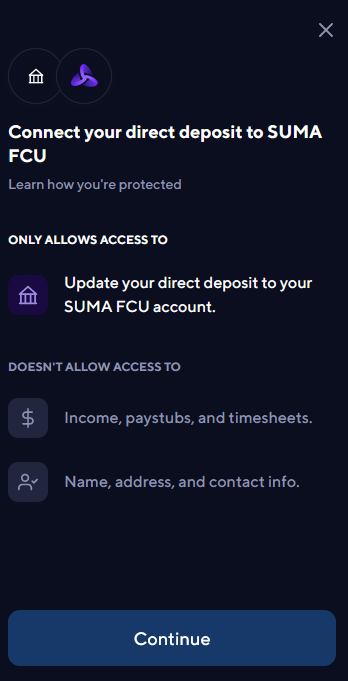

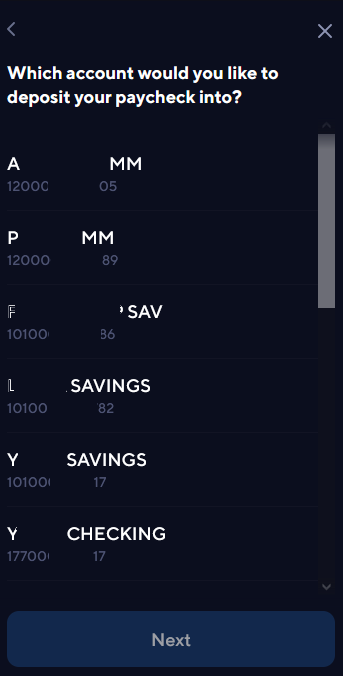

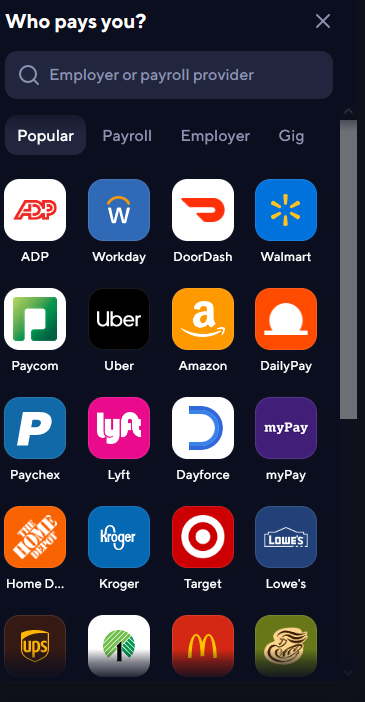

2) After clicking on the “Set up direct deposit” button, a new window opens confirming what is and what is not accessed during this process:

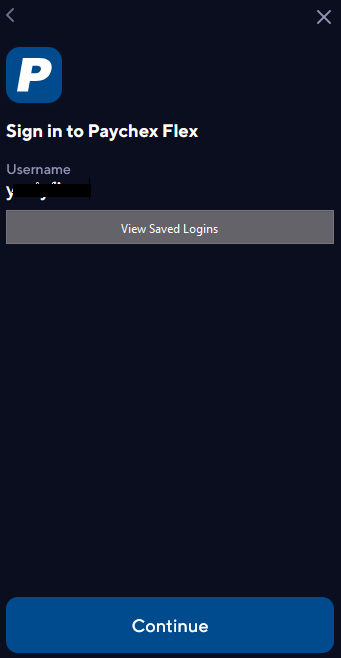

5) After choosing your direct deposit provider, you will see a login window to your provider:

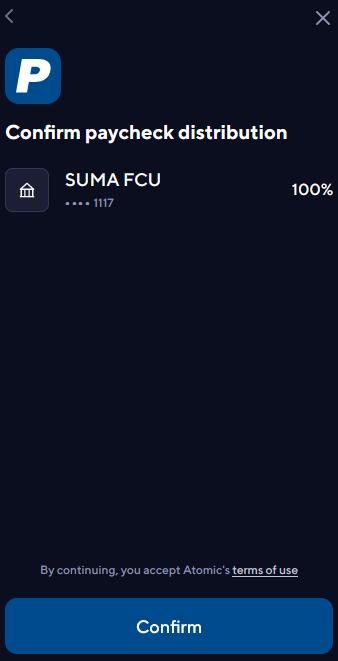

6) After successful login, the “Confirm” button appears - once clicked, the switch is performed:

Note: It may take 1 or 2 payroll cycles (depending on the employer/agency) for a switch to complete.

Some payroll providers, employers, or government agencies may require additional verification steps.

If you provider is not listed, reach out to us. We can provide paperwork that you can show your company's HR department to speed up the desired direct deposit switch.

Feel free to contact us, at any point through the process, if you have any questions.

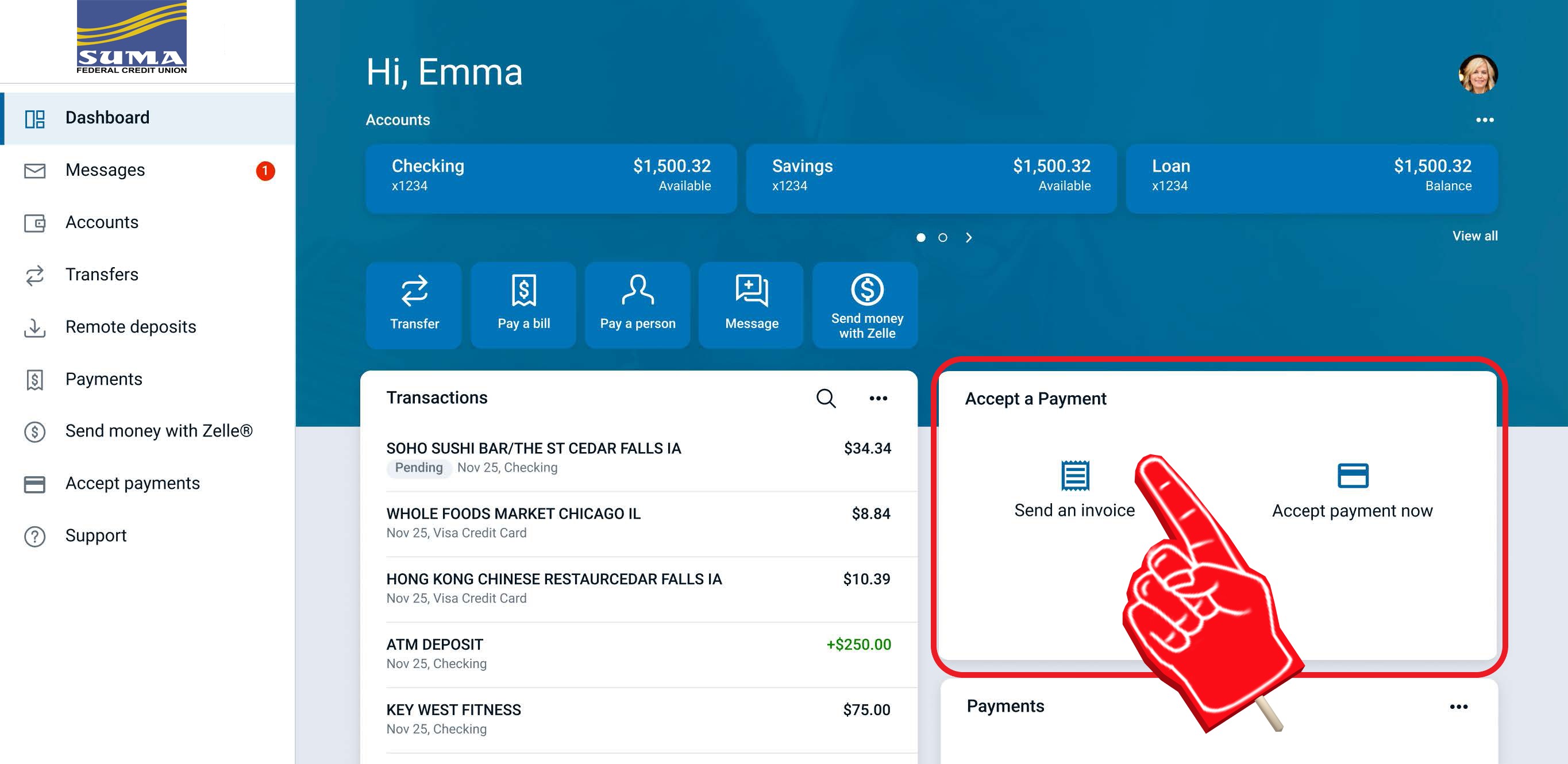

Save money, time and don't let invoicing and payments get in the way of running your small business or non-profit organization!

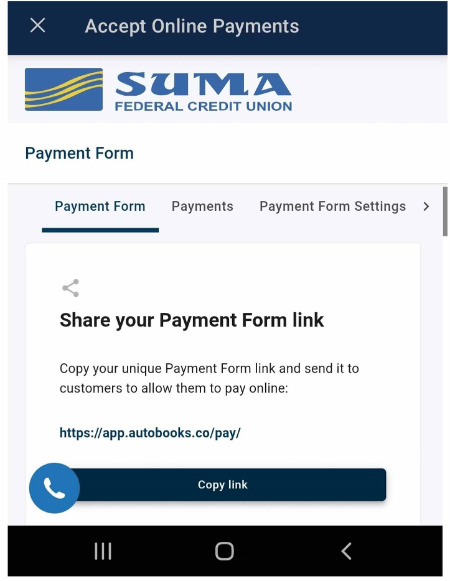

Integrated invoicing and online payment acceptance is now available for small and micro businesses through Autobooks within your SUMA FCU Digital banking (Opens in a new Window) application - with no monthly fees.

This means that you can now easily share your unique QR code with paying customers, and continue to reuse the same QR code as the need arises.

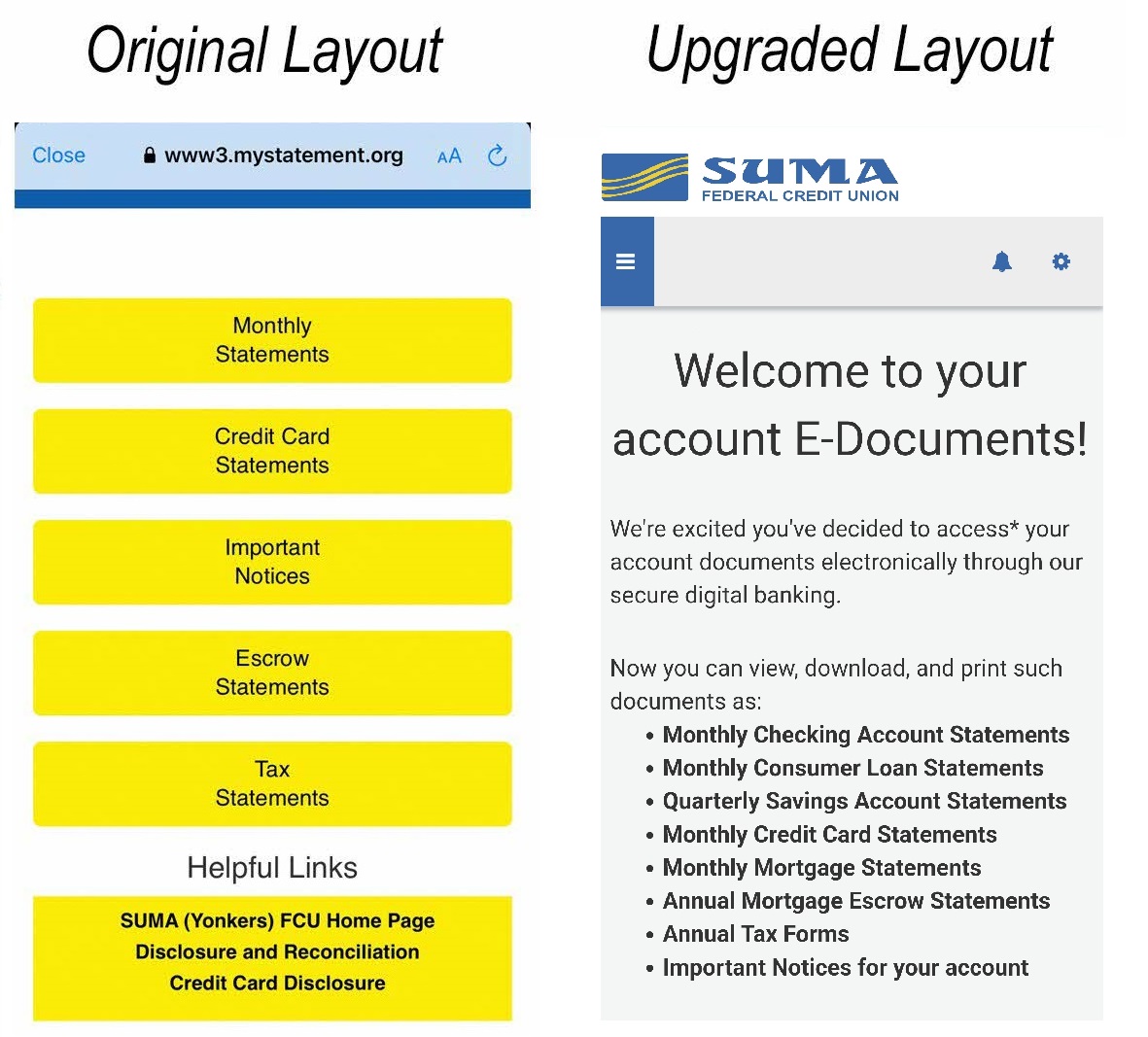

The main advantages of this new interface:

- Easier to navigate

- ADA compliant – more user friendly to people with disabilities

- More secure due to upgraded technology

- Additional modern technology (e.g.- HTML-enriched email reminders and the possibility to enrich electronic documents with clickable links, embedded images and videos)

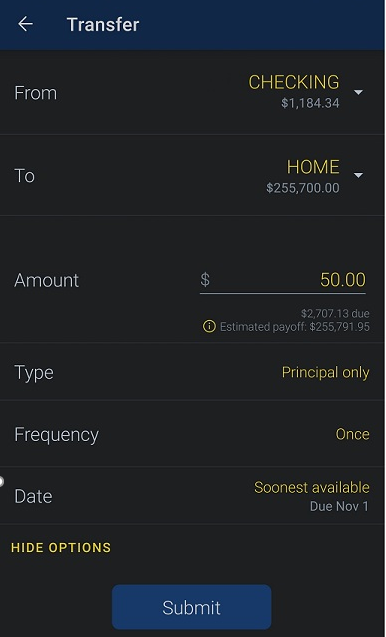

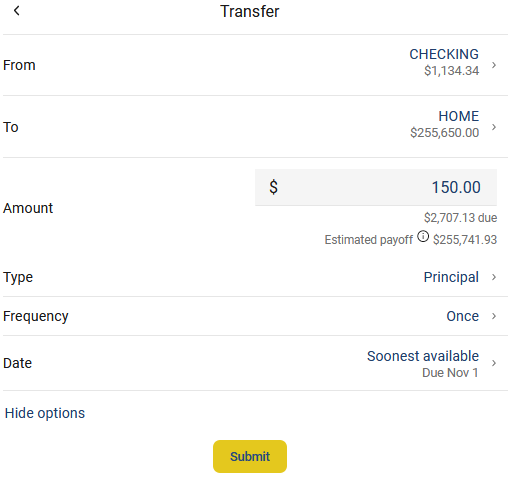

We just enabled a Principal Only Loan Payments option in our SUMA FCU Online & Mobile Banking platforms

To make either a one-time or recurring principal loan payment:

- Go to the TRANSFER tab

- Choose your From share account to fund the payment

- Choose the To loan account you wish to pay

- Input the Amount of your payment

- Expand the More Options menu

- Change the Type from the drop-down from “Regular” to “Principal Only”

- Change your Frequency (default is Once) and Date (default is Soonest available) options, if applicable

- Then hit the “Submit” button!

This is how the Transfer page with the “Principal only” feature chosen looks like in SUMA FCU Mobile app:

This is how the Transfer page with the “Principal only” feature chosen looks like in SUMA FCU Online Banking:

Bad threat actors continue to be very active and attempt to take advantage of everyone to commit fraud. SUMA FCU, in collaboration with its top-rated cybersecurity partners, is now offering its Cyberthreat Prevention webpage with the very latest in digital security topics to keep you aware of current issues and to hopefully protect you so that you can avoid the many pitfalls.

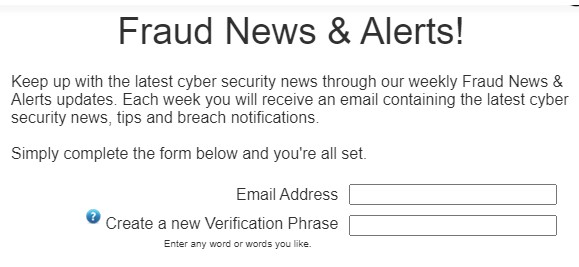

SIGN UP to receive a weekly email with the latest information to keep you up-to-date